CREDIT REPAIR

RECOVERY

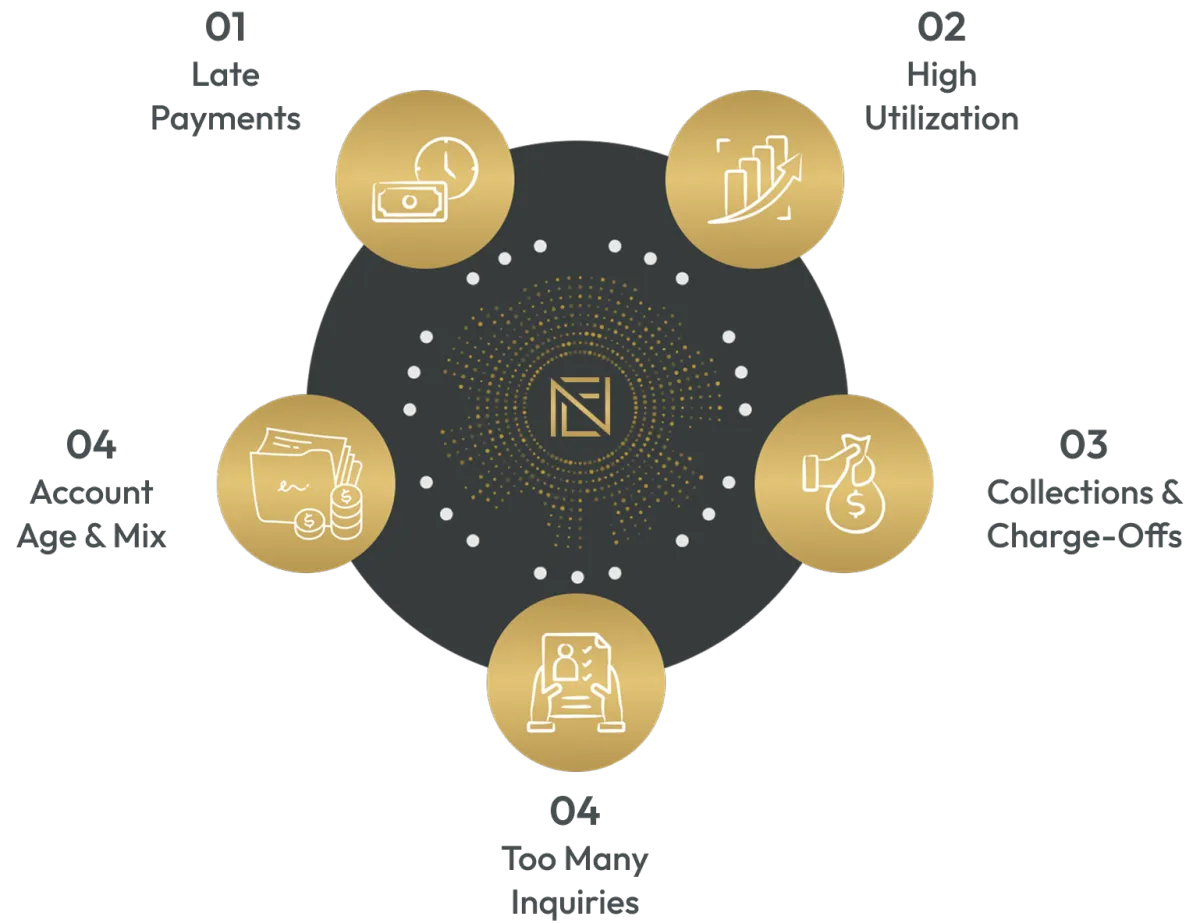

Wondering what’s actually hurting your credit score?

Ready to see how we remove negative marks and rebuild it? Get a personalized plan by emailing getting a free consultation call below.

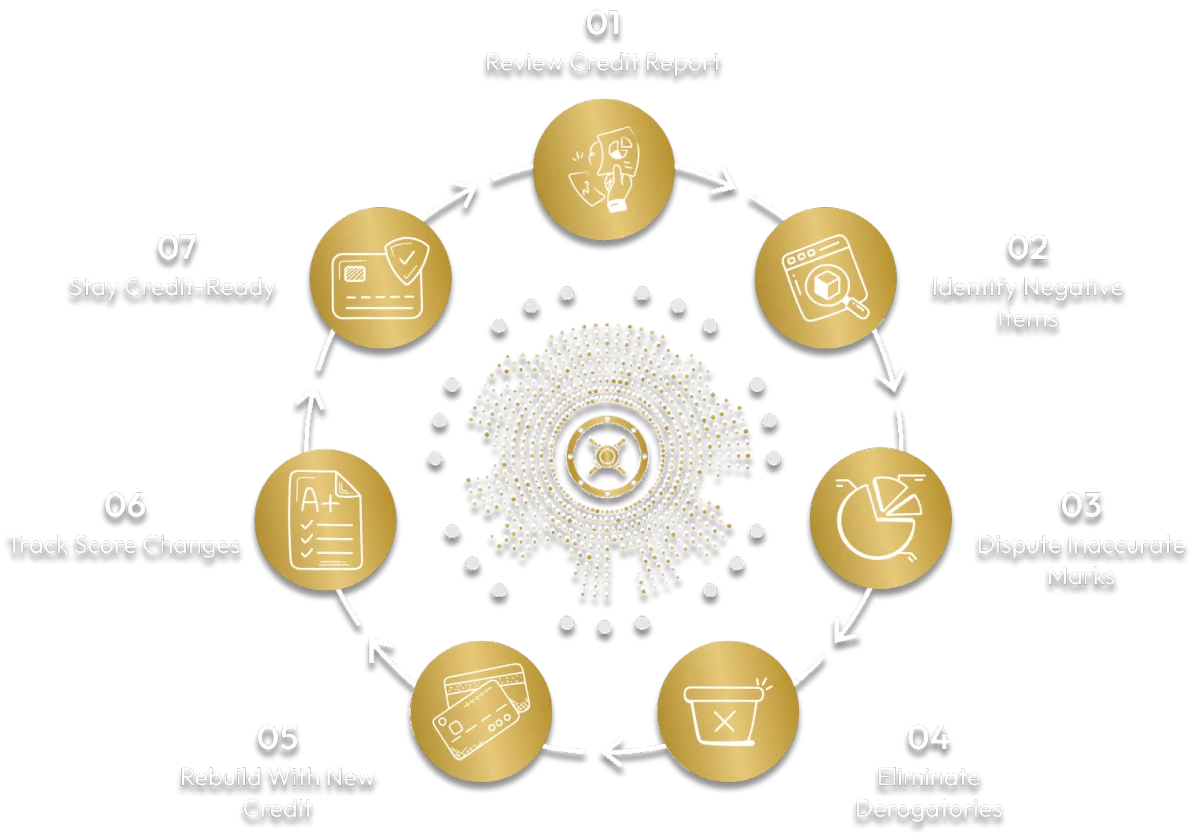

Our Credit Repair Process

Step-by-Step Score Recovery With Real Support

We begin by pulling your credit report and identifying every issue holding you back — from outdated inquiries to late payments and collections.

You’ll receive a clear breakdown of what's hurting your score and how to fix it.

We file disputes directly with credit bureaus and creditors to challenge inaccurate, unverifiable, or outdated negative items. Our team follows up regularly and handles all correspondence

After removals begin, we guide you through rebuilding your credit.

This includes opening the right accounts, managing utilization, and following proven strategies to increase your score.

You’ll receive regular updates and can monitor your results in real time.

We also prepare you to qualify for future business funding — with clean credit and smart credit habits.

We Keep It Simple, So You Can Stay Focused

We are built to restore confidence, even after financial setbacks.

Our 5 Step

Credit Repair Process

Start with a Full Credit Audit

Analyze all 3 bureaus for errors and negatives

Flag outdated items and score-draining accounts

Identify dispute-ready collections and inquiries

Review utilization, age of credit, and mix

Build a baseline to map your recovery plan

Identify Credit Barriers

Pinpoint What’s Holding Your Score Back

Remove What Doesn’t Belong on Your Report

We file disputes directly with the credit bureaus on your behalf.

Using proven methods, we challenge late payments, charge-offs, and collections that are outdated, inaccurate, or unverifiable.

Remove outdated negative marks

Dispute collections and inquiries

Eliminate unverifiable accounts

Improve score across all 3 bureaus

Get real-time dispute tracking

See updates as removals process

Rebuild with Strategy

Boost Your Score Through Smart Credit-Building Steps

We guide you through proven, low-risk credit-building tactics — helping you increase your score and become funding-ready without adding unnecessary debt.

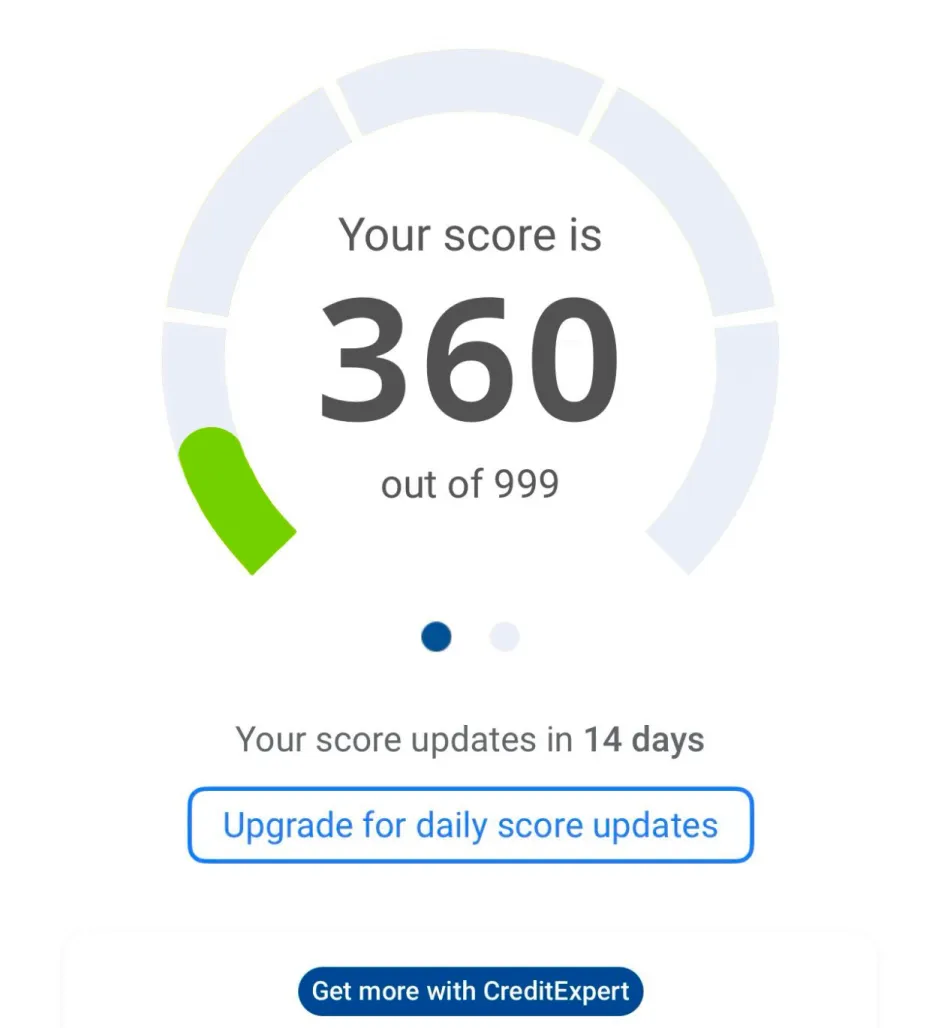

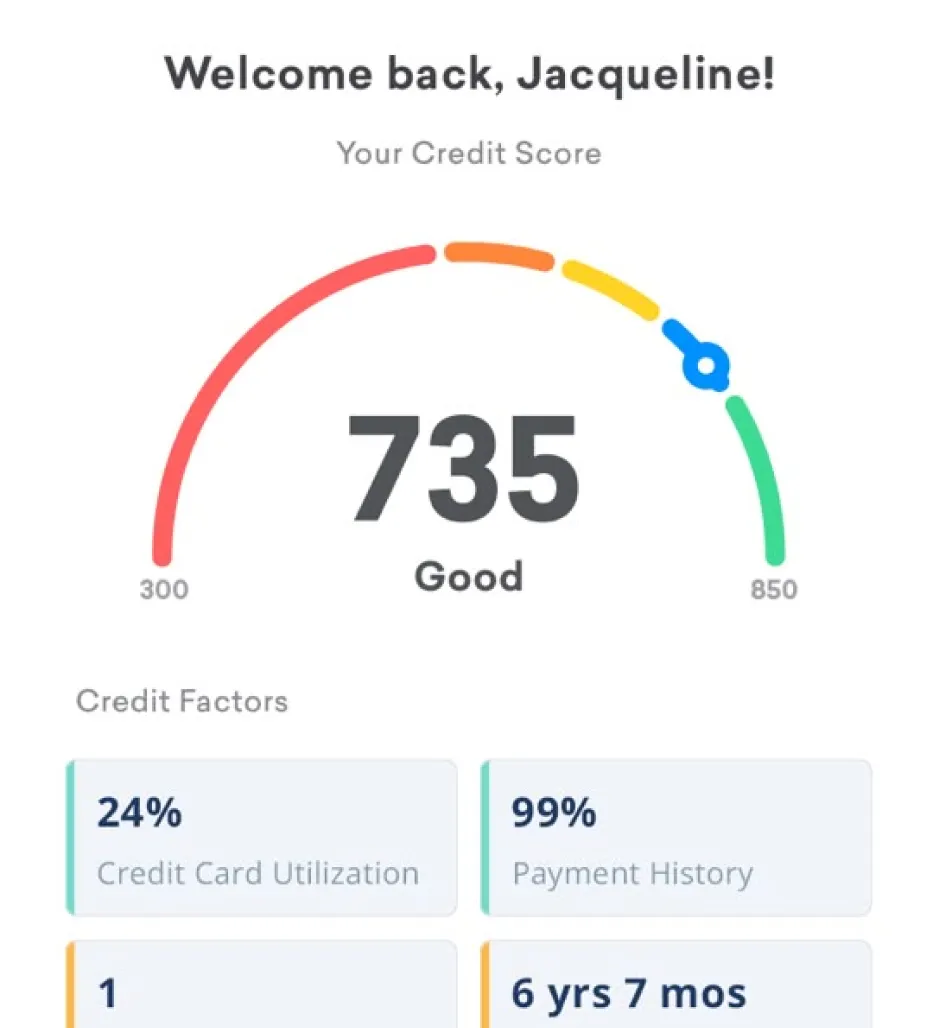

Before Next Level Funding

After Next Level Funding

Ongoing Credit Monitoring

We track your credit activity across all three bureaus.

If anything new appears — good or bad — we see it and act fast.

You’ll get alerts on any changes, and we’ll continue making sure your credit stays clean, protected, and ready for funding.

What Our Current Clients Are Saying About Next Level Funding

Frequently Asked Questions

We’ve answered the most common ones so you can move forward with confidence.

How long does it take to see results?

Most clients start seeing changes within 30 to 60 days. Full results can take a few months depending on your credit history and the number of items we're disputing.

What types of items can you remove?

We dispute and remove inaccurate, outdated, or unverifiable items like late payments, collections, charge-offs, repossessions, and hard inquiries.

Do you work with all three credit bureaus?

Yes — we handle disputes with Experian, Equifax, and TransUnion so your entire credit profile is covered.

Is this a one-time service or ongoing?

It's a done-for-you program that includes both one-time clean-up and ongoing credit monitoring to help protect your progress.

Do I have to do anything on my end?

Nope — we handle everything for you. All we need is your credit report access and basic info to get started.

READY TO FIX YOUR CREDIT WITH NEXT LEVEL FUNDING?

LET’S START REBUILDING YOUR SCORE TODAY.

NEXT LEVEL FUNDING2025 © | Disclaimer | Privacy Policy